ISO 22058:2022 pdf download.Construction procurement — Guidance on strategy and tactics

4 Options for engaging the market for new or refurbished construction works

4.1 Concept

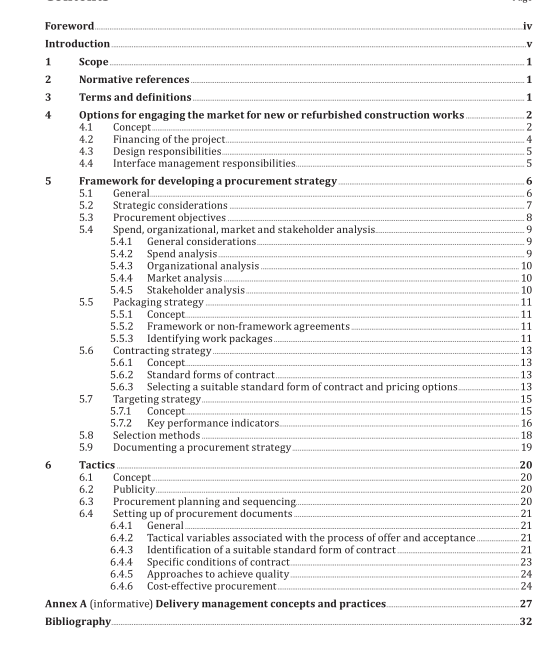

A client, where new or refurbished construction works is required, needs to answer basic questions relating to (see Figure 1):

— the financing of the project on a “buy” or “make” basis (see 4.2), and

— if the decision is to “make”, whether or not design responsibilities (see 4.3) and / or responsibilities for the management of interfaces between direct contracts (see 4.4) are to be retained or transferred.

This is an important decision as the choice of “buy” or “make” determines the number of contracts that need to be procured and directly overseen as well as the capacity and capabilities of the client delivery management team which needs to be put in place to oversee the delivery of the required construction works (see Annex A). It also informs the procurement strategies that are adopted (see Clause 5). It may be necessary to perform certain feasibility studies and financial exercises including commercial, economic and fiscal feasibility prior to a contract being concluded. Strategies such as early contractor involvement, or where the other party to the contract is likely to subcontract most of the works, early supply chain involvement, may need to be pursued.

It may also be important to engage in strategic collaboration to embed economic, social and environmental value and align expectations regarding practices such as those relating to health and safety and employment.

These questions derive from the differences between historical contracting methods and provide a basis for a systematic approach to the procurement strategy for future projects that will remain contextual despite new terms for different approaches being coined.

4.2 Financing of the project

It is possible that the source of funding is not an option as it can be a matter of policy or regulation for any given client. The financing of the project on a “buy” basis requires the market to pay for the acquisition incrementally as the client pays only for completed work. Under this financing mechanism, the developer typically carries the cost of providing the required construction works and commonly receives payment either in the form of a lump sum, a monthly amount for the term of the contract or a percentage of the income stream following the completion of the project. The options commonly available to the client where the market funds the acquisition are indicated in Table 1.

The parties to the contract can agree to share skills, technology and responsibility and transfer risks. Partnership arrangements can take on different forms to address issues such as spreading the cost of investment over the lifetime of the construction projects, greater predictability over cost and time, lowering of procurement costs, flexibility of programme delivery, performance incentives, potential to be off-balance sheet, ability of public sector to retain influence over strategic decisions, potential for continuous improvement through successive phases of work and early commercial input from private sector parties. Public sector partnering arrangements vary with the level of involvement and risk that the private entity holds in the arrangement with the public entity and how projects are financed. Partnership arrangements can range from simple collaboration to mitigate risks to the transfer of risks to the private party to the extent that this party puts its own capital at risk by funding its investment in the project with debt and shareholder equity. Partnership arrangements may also include the setting up of joint ventures to deliver specific projects, payment based on successful delivery, transferring of institutional function to the private party and permitting the private party to make use of public property.ISO 22058 pdf download.